One of my grad school mentors met me for lunch in New York ten years ago. His latest solo show had just opened in Chelsea. “I’ve outlived my market,” he lamented, proceeding to explain how one of his paintings had just sold at Sotheby’s for around 20% of what his gallery was asking for comparable works. I told him not to worry. Such disparity in prices is far from unusual. Auction prices realized in the secondary market are often less than what galleries can get for previously owned works. The belief that low auction results undermine retail price-points is conflating apples and oranges. Let me explain.

Forgetting the blue-chip market, where only a minuscule percentage of primary sales command exorbitant sums, most artwork is consumed as upscale lifestyle accessories and luxury home goods in a variety of niche-markets such as western art, wildlife, historical, and maritime art, or in the academy kunstvereine remnants of 20th abstraction, poetic realism, conceptualism, and installation art. People speak ofthe art world, when in fact there are many.

Galleries that show new works by an artist base their pricing on perceptions of value, such as past performance, and whatever the local market will bear. Works by emerging artists are underpriced to entice buyers. When demand for these artworks increase, prices will gradually rise—a process conditioned by where such artworks are sold. Rural venues in a remote location will ask less than urban galleries for comparable works of art, except for locations with seasonal populations of considerable wealth. The Long Island Hamptons and Marfa, Texas come to mind.

Art prices fluctuate like any commodity, in response to economic conditions. The art market thrived during the 1960s and ‘70s building boom driven by Urban Renewal and the development of automotive suburbia. The art market suffered, like everyone else, from the Savings & Loan Crisis of 1985-95, and the Global Financial Crisis of 2008. When I asked a prominent downtown art dealer how galleries could lower their prices to accommodate market adjustments without undermining perceived values, I was told that if an artist was known for paintings, the gallery might market their prints or photographs. Artist reputations would not take a beating because of a drop in their prices which, like soybeans, pork bellies, bullion, and real estate, are subject to financial realities.

Galleries often price works of art by the square inch, reflecting how the values of dwellings and commercial spaces are reckoned by square feet or meters. Demand for contemporary art can be fickle, as subjects, styles, and cause cèlébres that are all the rage quickly fall out of favor. Conservative buyers are mistaken in thinking that antiques are a safer bet, owing to limited supply. Chippendale, Hepplewhite, and Chinese Export porcelain were very desirable during the American bicentennial. Brown furniture tanked forty years later, while the market for blue-and-white porcelain is still going strong.

I had a relationship with a woman working in the haute couture textile industry who explained that design teams from YSL, Armani, Lagerfeld, Ralph Lauren, and others would hold summits at remote locations—such as a tropical island or alpine schloss, to plan the cut, color, and pattern of future clothing lines. This gave manufacturers time to produce yard goods, trimmings and notions, and PR firms time to prepare marketing campaigns. New collections had been predetermined five years before they were trotted out on runways.

Art dealer syndicates operate in a similar fashion. Multiple investors buy shares in a rare work of art—a painting by Rembrandt, Monet, or Van Gogh. The picture might be loaned to a museum, or exhibition, and reproduced in books or periodicals. Selling at auction always involves some degree of risk for both consignor and buyer. The piece may be privately offered to selected buyers in advance of an auction sale. Shareholders receive a proportionate share of the profit or absorb an equal percentage of any loss. Only dealers are welcome to join in these round-robin schemes. Investors can gamble on auction by betting that lots will exceed the reserve price in exchange for a percentage of the gains. Auction houses are assured of sale, while guarantors stand to profit on higher bids, or buy lots at discount prices. This derivative market has attracted third-party investors, while newfangled art banks sell percentages of high-performing artworks. The art never leaves the warehouse. It just sits there like the gold at Fort Knox.

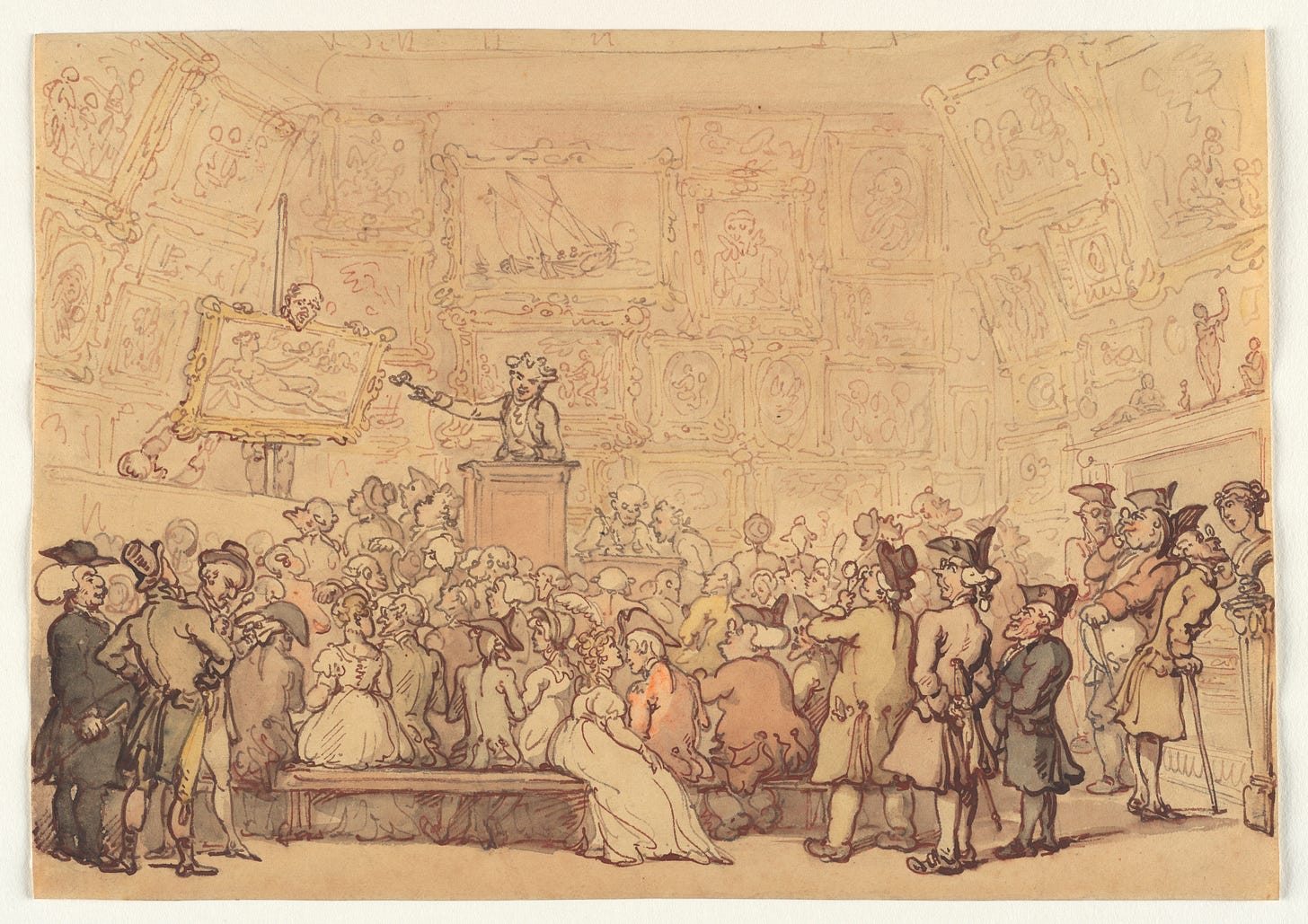

A colossal misconception cherished by academe is the art business is coherent and logical. When I mentioned “the gallery system” to successful New York art dealer, he laughed and declared there was no such thing. The art business instead is a volatile environment in which dealers and artists need to keep nimble. The dealer explained that his quotidian routine consisted of a light breakfast, reading The Wall Street Journal on his way into work, opening the gallery, sitting down at his desk with a cup of hot coffee, and deciding what to do. Nothing is certain. Every day is different. Adding to this uncertainty is how auctions morphed from wholesale markets to retail venues. My antique dealer friend complained decades ago that when collectors started buying at auctions, it put him in the awkward position of competing with his own customers.

Many antiques shops and galleries are kept afloat by a following of loyal buyers and collectors. Bespoke tailors’ clients seldom shop at Marshall’s. Nor do gallery customers flock to the electric anonymity of auction sales. The viability of brick-and-mortar galleries have been diminished by the proliferation of art fairs. When I first attended the Basel Kunstmesse in 1989, everyone was there on a mission. It felt more like the Olympic games or a political convention than today’s glitzy bazaars. Traveling from Paris to Basel with a Parisian friend, we found ourselves across the aisle from Masami Teraoka, who had just completed an astonishing homage to the Ukiyo-e tradition about the AIDS epidemic. At lunch two days later with Paris art dealer Darthea Speyer in the donut-hole beer-garden of Messe Basel we were joined by Nancy Spero and Leon Golub, Larry Mangel, and a film star who had just flown in from California. There was then a more rarified air than one finds in art fairs today, where curators and collectors rub shoulders with random flaneurs, and the general public.

Works of art that sell for a pittance at benefit auctions do not undermine gallery pricing because they are not sold in a retail environment. Artworks might be offered in a second-tier market at Big City prices but sell at a discounted rate, with no one the wiser. The Most Appropriate Market is a central concept in appraisal practice that refers to those locations where a specific property is in highest demand. Navaho blankets will bring higher prices at Scottsdale than in Mumbia. Homoerotic paintings might fly off the wall in Provincetown but find fewer buyers at Holy Roller revivals in rural America. Where something sells can determine its price.

When a lot comes up for sale at auction, the house will publish a price-spread of high and low estimates, based on past sales of comparable properties, with the consignor’s consent. If a lot fails to sell, the record may show it was “passed”. Some auction houses record no hammer price (the winning bid, less the buyer’s premium) to downplay the taint of disinterest. Lots might fail to sell because consignors may have insisted on high reserves (the rock- bottom prices they are willing to accept), which is usually 10-20% below the low estimate. Auction houses might hold onto passed lots (also known as buy-ins) for several weeks, hoping to attract later offers. When these fail to sell, they are returned to consignors as “burned” —rejected by the market. Such lots may need to “cool down” for three to five years before making another attempt to sell at auction. Motivated sellers might consign these doomed goods to private dealers whose clients seldom follow the auctions. Questions arise about how run-of-the-mill contemporary galleries approach pricing in ways that are disadvantageous to artists. The next installment in this series will explore those concerns in detail.

(To be continued)

—James Lancel McElhinney © May 7, 2025

NB: All images herein are reproduced under Fair Use, etc. The views expressed above are opinions, based on personal experience. Visit my website at https://www.mcelhinneyart.com or contact me at james@mcelhinneyart.com

I wonder why owners chose to sell a family art collection or piece at a gallery vs at auction. Maybe it's the same reasons you listed for purchasers. The art owner may have a relationship with the gallery, or not want the work possibly underpriced at auction and would rather just get it back. In other works, how do galleries get to represent an artist's estate? Is it more or less prestigous to auction off work at Sotheby's vs a NY or a London gallery?

Also, about buying, galleries are showing "new work" by contemporary artists. This must appeal to some buyers and collectors. Auctions are selling "old work". To buyers, this requires more judgement and may intimidate to some who don't know enough to be sure this is a "good" example of an artists work.